On November 24, 2023, the U.S. Treasury Department released proposed regulations (REG-131756-11) that would amend existing regulations under §267 and §707 relating to the disallowance or deferral of deductions for losses and expenses in certain transactions with partnerships and related persons. The proposed rules are intended to update the current regulations to reflect changes since 1982 and align the regulations with Congressional intent to treat partnerships as an entity rather than as an aggregate of its partners for purposes of applying related-party loss disallowance rules.

Effective Date: The proposed regulations would apply to tax years ending on or after the date on which the regulations are published as final.

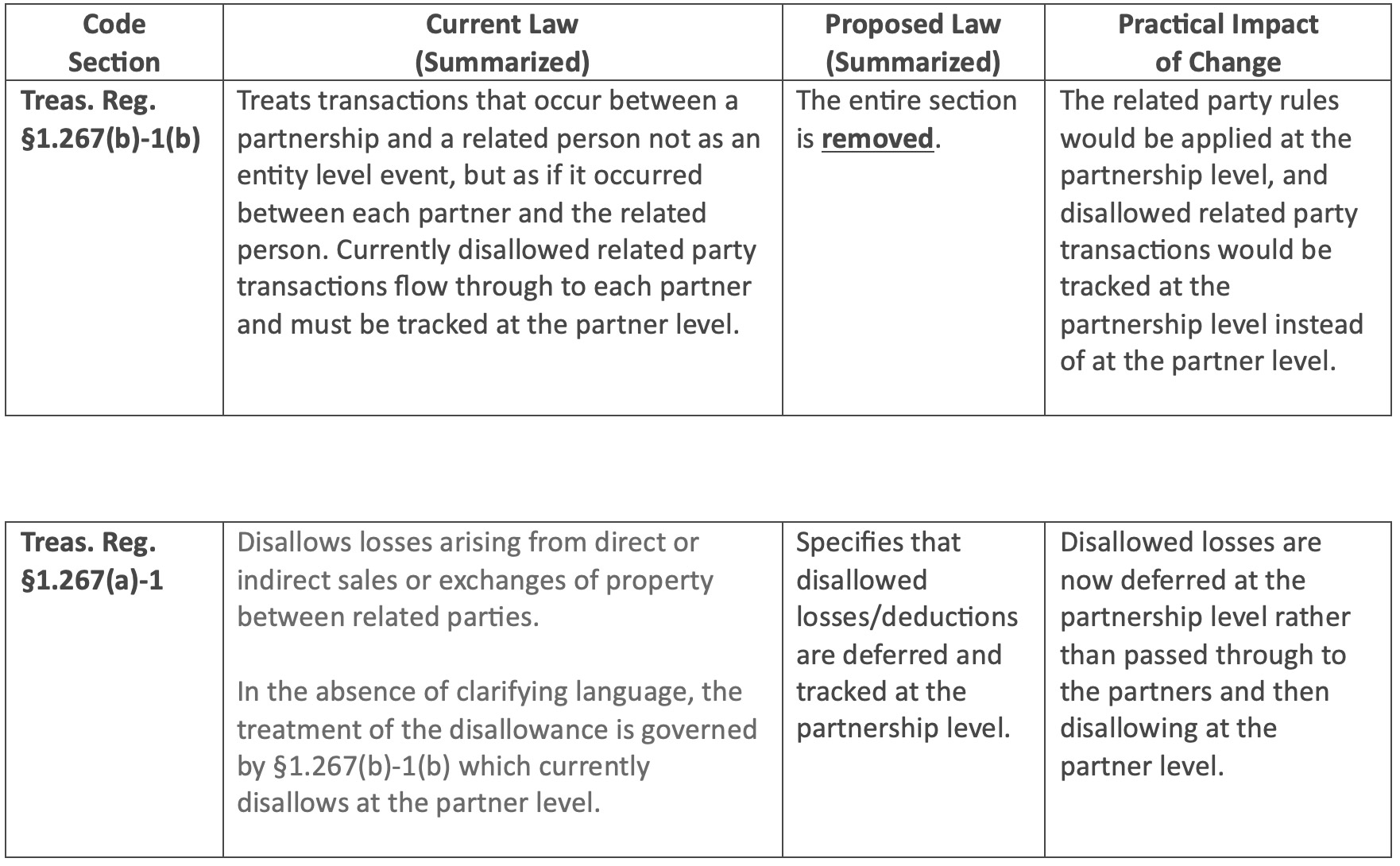

The proposed changes can be summarized as follows:

- Remove Treas. Reg. §1.267(b)-1(b) that treats a transaction that occurs between a person and a partnership as occurring between the person and each partner.

- Amend Treas. Reg. §1.267(a)-1 to disallow losses and defer otherwise deductible amounts at the partnership (entity) level.

- Amend Treas. Reg. §1.267(a)-1 to (i) to reflect the rules in Questions and Answers 1 and 4 in Temp. Reg. §1.267(a)-2T(c) as Treas. Reg. §1.267(a)-1(d)(2) and (3) and (ii) terminate the application of Questions and Answers 2 and 3 in Temp. Reg. §1.267(a)-2T(c).

- Amend Treas. Reg. §1.707-1(b)(1) and (b)(2) by replacing the term “partner” with the term “person,” and replacing “80 percent” with “50 percent” in Treas. Reg. §1.707-1(b)(2) to reflect the statute.

The chart below provides additional details of the proposed changes.

If you have any questions related to proposed §267 and §707 regulations, please do not hesitate to reach out to us for assistance.